While Canadian retail posted modest growth in 2024, Toronto’s unique retail environment tells a different story, according to new data from J.C. Williams Group’s Canadian National Retail Bulletin. The city’s -0.01% year-over-year performance stands in sharp contrast to the national average of +1.30%, revealing how Canada’s largest city faces distinct challenges that are reshaping its retail corridors.

Toronto retail sales remained essentially flat in 2024 (-0.01% YTD), significantly underperforming compared to Vancouver (+1.11%), Montreal (+1.29%), and the national average (+1.30%). This performance gap points to unique pressures facing retailers in Canada’s largest metropolitan market.

“I think that because of sky high rents and living expenses in Toronto, people are much more fearful,” notes Lisa Hutcheson, Managing Partner at J.C. Williams Group. “They know that they’re already living right to the edge of their budget. And so, these fears of another increase in terms of their grocery bill or any other bill is tremendously scary for many people.”

The data reveals dramatic shifts in Toronto’s retail landscape compared to national trends:

| Retail Category | Toronto YTD | Canada YTD | Difference |

| Furniture Stores | -11.1% | -2.4% | -8.7% |

| Home Furnishings | +6.4% | -1.9% | +8.3% |

| Beer, Wine & Liquor | -6.2% | -2.9% | -3.3% |

| Cannabis Retailers | -5.5% | +0.8% | -6.3% |

This divergence reflects changes in consumer behaviour unique to urban environments. While cannabis retail boomed nationally, Toronto has seen significant closures despite initial rapid expansion.

“Cannabis is down 5.6% in Toronto compared to the country being up 1.5%,” Graham Heuman, Retail Insights Lead at J.C. Williams points out. “But beer and wine in Toronto’s down 6.2%, whereas the rest of the country’s down 2.9%. So, Toronto is really struggling with those categories.”

Similarly, furniture sales have plummeted in the city while home furnishings have surged, suggesting Torontonians are focusing on smaller-scale home improvements rather than major furniture investments – perhaps a reflection of the city’s smaller living spaces and budget constraints.

Economic Pressures Changing Shopping Habits

Economic pressures have fundamentally changed how Torontonians shop, pushing consumers toward value-focused retailers regardless of preference.

“It’s really difficult to think of any sort of retailers right now who would be successful without focusing on cost more so than even value propositions,” Hutcheson explains. “Whereas Loblaws might be a better shopping experience with nicer food options, the fact is that when rent goes up and condo fees increase, consumers adapt. Even if they don’t want to shop there, they’re still shopping at the value brands like No Frills or the dollar store because of economic necessity.”

This shift explains the growing prevalence of discount retailers in prime retail locations throughout the city. Even consumers who can afford premium shopping experiences are increasingly making pragmatic choices, with Hutcheson noting the paradox that “we’re paying to shop somewhere we don’t like the experience” when discussing warehouse memberships.

E-Commerce Growth Despite Challenges

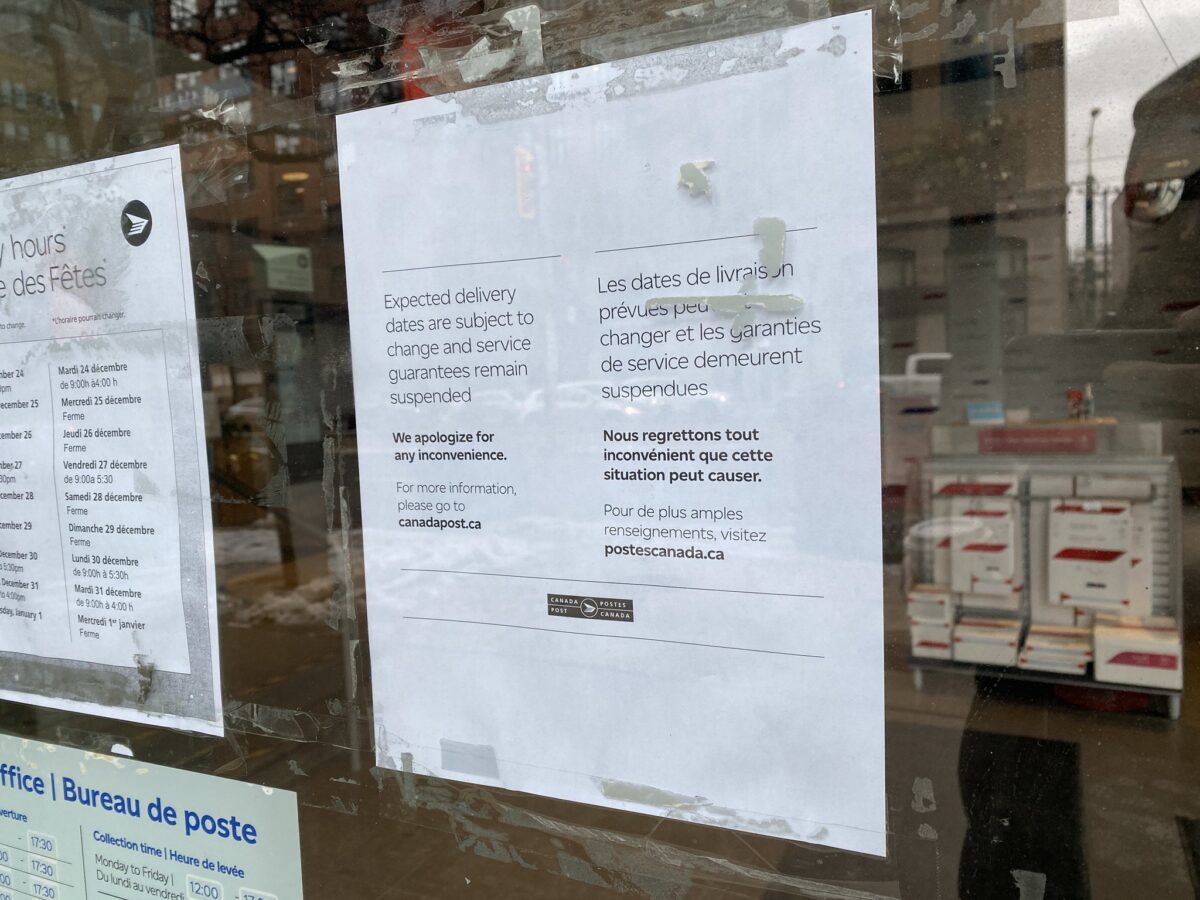

Despite a month-long Canada Post strike (November 15 – December 17), e-commerce grew 14.12% year-over-year in December nationally. This growth occurred despite shipping concerns, with Shopify reporting a 24% increase during the Black Friday to Cyber Monday weekend.

“I think the first and foremost from a strategy standpoint is no small businesses using Canada Post anymore. And I don’t think they’ll ever be again,” says Hutcheson. “Especially with the looming strike expected in May. So, the small businesses are like, well, no, that’s not happening.”

Hutcheson predicts lasting changes to delivery models: “I think we’re gonna see different delivery models because this is just opening with the Canada Post strike. With that strike and then another one coming, I think that they’ve all found alternatives and looking for alternatives.”

Mixed Results from Tax Holiday

The GST/HST tax holiday implemented in December produced mixed results, with many categories showing unexpected declines. Hutcheson observed significant consumer confusion about the program.

Despite being designed to boost spending, the tax break had limited impact on key categories:

- Supermarkets and Other Grocery Stores: down -0.4% YOY

- Convenience Stores: down -4.7% YOY

- Specialty Food Stores: down -2.0% YOY

- Beer, Wine, and Liquor Stores: down -7.9% YOY

This confusion, combined with concerns about upcoming tariffs on American goods, has created an atmosphere of consumer uncertainty that particularly affects Toronto shoppers already stretching their budgets.

“I think people are not getting a lot of information, but they’re getting enough to scare them,” Hutcheson notes. “Consumers are just not highly understanding, they’re just getting bits of information, and I think that is definitely impacting them.”

Implications for Toronto’s Retail Future

As Toronto’s retail landscape continues to evolve, several key considerations emerge for industry stakeholders:

Category Shifts Affecting Retail Space

The dramatic category shifts have significant implications for retail space allocation. With home furnishings up 6.4% but furniture stores down 11.1%, property owners should consider how their tenant mix reflects these changing consumer preferences. The data suggests smaller format stores focused on accessories and decor may outperform large-format furniture retailers in urban centre’s.

“I think we’re seeing a significant category shift that could reshape the city’s retail landscape in 2025,” notes Hutcheson.

Rethinking Delivery Models

The e-commerce resilience despite the Canada Post strike offers important lessons. Small businesses are already pivoting away from traditional shipping models, seeking alternatives that won’t be disrupted by potential future strikes. This creates opportunities for local delivery services and logistic startups focused on urban delivery solutions.

Toronto-Specific Strategies Required

The city’s retail dynamics differ substantially from national trends, requiring Toronto-specific strategies. Understanding the heightened price sensitivity of Toronto consumers is crucial—even more affluent shoppers are making value-driven decisions in categories that were previously less price-sensitive.

“This whole tariff thing is going to impact groceries particularly in fruits and vegetables,” Hutcheson explains, noting that “even Canadian Tire recently cited that 25% of their assortment is impacted.” This concern adds to consumer uncertainty, particularly in a high-cost market like Toronto.

Value Over Experience

Perhaps most tellingly, Toronto consumers are increasingly making pragmatic choices that prioritize value over experience—even when they can afford premium options.

Heuman highlights this paradox: “It’s really interesting from a value perspective we go to a shopping experience we don’t like,” referring to warehouse shopping.

This willingness to endure less enjoyable shopping experiences for better value suggests that retailers aiming to succeed in Toronto must deliver exceptional price value propositions, even if they operate in traditionally “premium” categories.

As we continue to monitor Toronto’s retail performance throughout 2025, these divergences from national trends bear watching. For retailers, property owners, and brands, understanding Toronto’s unique retail environment will be critical to navigating the city’s challenging but opportunity-rich market.

This article is the first in a series analyzing retail trends in Toronto based on J.C. Williams Group’s Canadian National Retail Bulletin. Follow 6ixRetail.com for monthly updates on the evolving retail landscape across the GTA.

Dustin Fuhs is the Editor-in-Chief of 6ix Retail. He is the former Editor-in-Chief of Retail Insider, Canada’s most-read retail trade publication. He has over 20 years of experience in the retail, marketing, entertainment and hospitality industries, including with The Walt Disney Company, The Hockey Hall of Fame, Starbucks and Blockbuster.

Dustin was named as a RETHINK Retail Top Retail Expert in 2024 and 2025.